The number sounds too extreme to be real: a 245% tariff on Chinese goods. As trade tensions between the U.S. and China escalate, this jaw-dropping figure has been circulating widely, sparking fear and confusion—especially among e-commerce sellers and importers. But what does it really mean? Is the U.S. truly slapping a 245% tax on everything from China? And if so, how would that affect Amazon sellers and American consumers?

This article separates fact from fiction and provides context for the 245% figure, explains the categories where it applies, and explores what it means for businesses caught in the crossfire of a rapidly intensifying tariff war.

Where Did the 245% Tariff Figure Come From?

On April 15, 2025, a White House fact sheet buried in a briefing on critical minerals quietly dropped a bombshell: that China now “faces up to a 245% tariff on imports to the United States.” The phrase was vague, but powerful. Suddenly, headlines erupted and questions flew—did the Trump administration just triple the cost of doing business with China?

Not quite. The key words were “up to.” That figure doesn’t refer to a blanket tariff on all Chinese goods, but rather the highest effective tariff rate currently in place on specific product categories, most notably syringes and electric vehicles. These extreme rates are the culmination of several waves of tariffs spanning two presidential administrations, layered over time.

How the U.S. Got to 245%

The path to this astronomical tariff has been gradual but relentless:

- Initial Trump Tariffs (2018–2020): Beginning in 2018, the U.S. applied a range of tariffs on hundreds of Chinese goods, initially at 10% and later 25%.

- Biden Era (2021–2024): The Biden administration maintained most of Trump’s tariffs and added targeted increases on critical goods like semiconductors and medical supplies.

- Trump’s Second Term (2025): Since January, President Trump has re-escalated the tariff war, introducing a 10% baseline tariff on all imports and layered reciprocal tariffs on specific countries. For China, the effective tariff rate reached 54% by March, then 104% in early April, and now—at least for two product classes—245%.

This highest-tier rate applies only to a narrow slice of imports, specifically Chinese electric vehicles and syringes. The rationale? EVs are seen as a national security and industrial strategy priority, and syringes were identified as a supply chain vulnerability during the pandemic.

Does This Mean All Chinese Goods Are Taxed at 245%?

No. While 245% is technically accurate for certain goods, it’s misleading to suggest that every product from China faces this duty. In fact:

- Smartphones are currently tariffed at 20%.

- Children’s books are tariffed at 0%.

- Toys face tariffs of up to 145%.

- Most consumer electronics fall between 20–54%.

- Clothing and home goods often sit in the 34–54% range.

In essence, the 245% figure reflects the outer limit, not the norm. Still, even at 54–104%, many of the most common product categories sold on Amazon are experiencing crippling cost increases.

What It Means for Amazon Sellers

Even if 245% doesn’t apply across the board, the impact of the tariff escalation is enormous for Amazon sellers. Consider these implications:

- Margins Vanish Above 50% Tariffs

Tariffs below 50% squeeze profits; above 50%, many sellers are priced out of the market. With the average Amazon seller operating on a 15–20% net margin, these tariffs are unsustainable without major changes. - Trade Becomes Uneconomical at Extreme Levels

At 245%, the cost of goods would more than triple. Importing Chinese electric vehicles, for instance, becomes infeasible—not just costly. For product classes nearing this threshold, trade effectively halts. - Supply Chains Shattered Overnight

Many sellers have spent years building reliable supply chains in China. Changing suppliers or production locations is not a quick fix. A sudden tariff like this forces rushed decisions and logistical headaches. - Product Categories at Risk

Items such as syringes (including some medical accessories), toys, and electronics are among the hardest hit. Sellers in these categories may need to halt listings, raise prices sharply, or pivot to new products altogether. - Credibility is Now a Differentiator

In this volatile climate, where price increases are inevitable, trust becomes your advantage. Sellers must work harder than ever to justify higher prices—and that means building credibility through reviews.

Standing Out When Costs Are Rising: Reviews Matter More Than Ever

With margins squeezed and costs soaring, sellers need to find a non-price-based edge. One clear way to stand out: credibility.

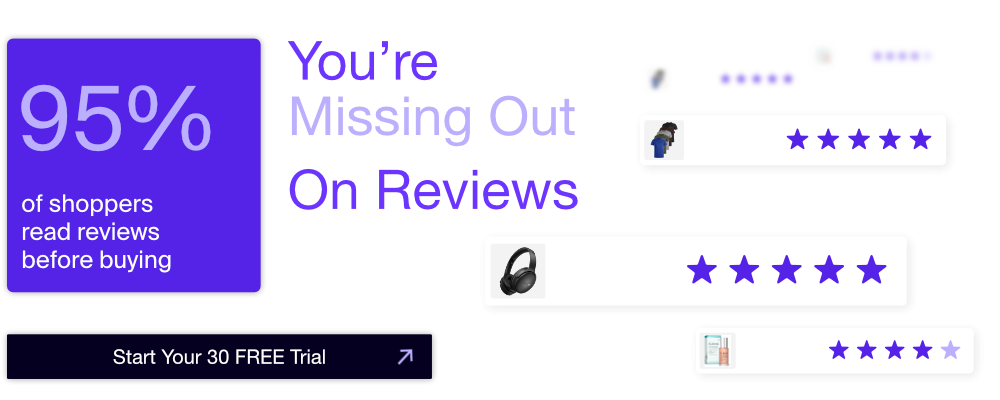

Recent studies show that 95% of Amazon shoppers read reviews before buying. In fact:

- 45% won’t buy at all if a product has no reviews

- Consumers trust verified reviews more than product descriptions

- Review volume and recency directly affect conversion rates

When shoppers are faced with rising prices, they will instinctively gravitate toward sellers they trust. That trust is built through consistent, authentic, and recent reviews.

Key Takeaway: Tariffs Are High—So Your Reputation Needs to Be Higher

Sellers can’t control global tariffs. But they can control how they present their products to shoppers.

- Boosting your product review count

- Responding to feedback promptly

- Ensuring your products consistently earn 4.7–4.9 stars (the sweet spot)

These are the strategies that separate winners from losers in a high-cost environment.

Conclusion

The 245% tariff figure has shocked the e-commerce world—but it's also a symbol. Whether it's 54%, 104%, or 245%, the message is clear: trade with China is no longer cheap, easy, or predictable. The only way to stay competitive is to adapt quickly.

Sellers must re-evaluate their sourcing, pricing, and marketing strategies. But above all, they must build trust with shoppers—because in a world of rising prices, credibility is king.