On April 9, 2025, President Donald Trump intensified his trade war with China by officially raising the tariff on Chinese imports to 125%, effective immediately. In a surprise parallel development, he also announced a 90-day pause on further tariff hikes for over 75 other countries, including key U.S. trade partners such as the EU, Japan, South Korea, and Mexico. During this pause, a flat 10% reciprocal tariff applies across these nations to allow for negotiations and reduce immediate disruption.

For Amazon sellers, these developments mark a critical inflection point. The sharply escalated China-specific tariff effectively prices many Chinese-made goods out of the market, while the 90-day pause gives sellers limited breathing room to assess, adapt, and reposition.

This article explains what these changes mean, which products are most affected, and how U.S.-based Amazon sellers can strengthen their credibility and performance in this volatile environment.

What Was Announced: Key Tariff Measures

- 125% Tariff on All Imports from China

- Effective immediately as of April 9, 2025.

- Applies to all Chinese-origin goods, with no grace period.

- Designed as a direct response to China’s latest 34% retaliatory tariff on U.S. exports.

- 90-Day Pause on Tariff Escalation for 75+ Nations

- Applies a flat 10% tariff during this period.

- Intended to allow time for bilateral negotiations.

- Includes: EU member states, Japan, South Korea, India, Vietnam, Bangladesh, Thailand, Indonesia, Pakistan, Taiwan, Canada, and Mexico.

- Tariffs could rise if no deals are struck by mid-July 2025.

- De Minimis Exemption Closed for China

- The $800 exemption on low-value shipments is no longer valid for goods from China.

- All imports from China are now fully tariffed regardless of value.

Impacts on Amazon Sellers: China vs. the Rest

Sellers Sourcing from China

- Cost Shock: Goods previously imported at a 0–25% duty now incur 125%. A $10 landed cost item could now cost over $22.50.

- Product Ineligibility: Many low-cost products sourced from China are no longer economically viable. Margins are wiped out.

- Sourcing Exit Required: Sellers must explore new countries or domestic production for affected SKUs.

Sellers Sourcing from Other Countries

- 10% Temporary Tariff: Imports from most other trading partners now carry a flat 10% duty.

- Planning Window: Sellers have until July 2025 to negotiate with suppliers, adjust pricing, and prepare contingency plans if tariffs rise again.

- Key Categories Affected:

- Electronics: Imports from Japan, Korea, and Taiwan.

- Apparel & Textiles: Vietnam, Bangladesh, and India.

- Furniture, Kitchen, Homeware: Thailand and Indonesia.

- Automotive Accessories: Japan and Korea.

Strategic Recommendations for Sellers

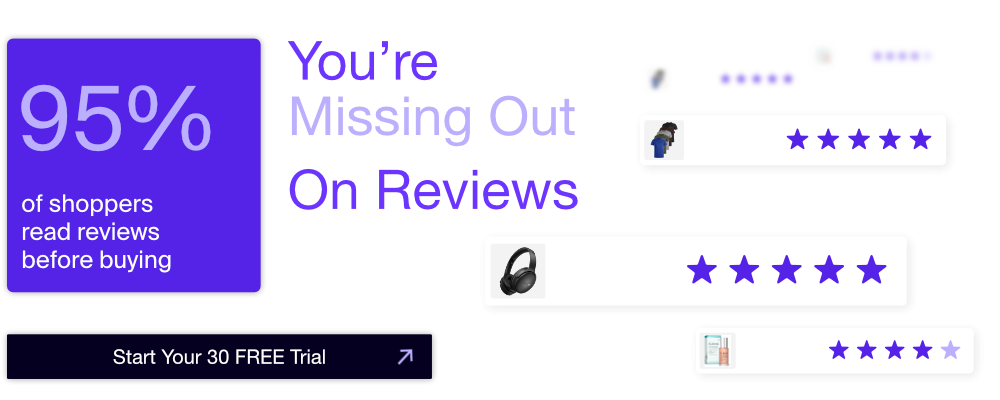

1. Strengthen Credibility to Win Buyers In a climate of rising costs and global instability, trust is a competitive advantage. Buyers are more selective, and listings with high ratings, strong seller feedback, and clear support information will perform best. Amazon sellers should:

- Automate Review Collection Using Amazon’s Approved System Use tools that send requests via Amazon’s “Request a Review” API (as Amzigo does) to grow verified reviews without breaching policies.

- Avoid Risky Review Tactics Stay away from tools or platforms that offer customizable review messages, which can breach Amazon's terms and result in account suspension.

- Provide Clear Product Information Automated delivery of warranty info, FAQs, or instructions via email (when compliant) boosts buyer confidence.

2. Reassess Product Viability

- Calculate new landed costs with the added tariff.

- Use Amazon’s fee preview and pricing calculators to determine profitability under the new duty regime.

- Consider pausing or removing unprofitable ASINs and reinvesting in resilient product lines.

3. Accelerate Sourcing Diversification

- Short Term: Stock up now from non-China suppliers before tariffs rise post-90-day pause.

- Medium Term: Identify manufacturing partners in Mexico, South America, or Southeast Asia (excluding China, Cambodia, Vietnam if tariffs rise again).

- Long Term: Explore U.S. manufacturing or white-label opportunities for premium positioning and duty-free import.

4. Optimize Operations to Protect Margin

- Renegotiate terms with suppliers to share tariff costs.

- Shift to slower, cheaper sea freight where possible.

- Review packaging and FBA prep costs for savings.

- Scale back advertising spend (especially on low-margin items) and optimize ACoS.

5. Adjust Pricing Gradually

- Raise prices incrementally to protect your Buy Box share.

- Monitor competitors using Amazon repricing tools and adjust dynamically.

- Test bundling or value-adds to justify price increases.

6. Manage Inventory with Caution

- Avoid overstocking high-tariff goods.

- Maintain lean inventory levels, but buffer against shipping delays.

- Use the 90-day window to build stock on top-selling SKUs before costs potentially increase again.

7. Stay Informed and Agile

- Watch for trade negotiations outcomes – tariffs may increase or be reduced by country.

- Subscribe to trade news and Amazon policy updates weekly.

- Keep communication open with freight forwarders and customs brokers to avoid documentation errors under the new tariff codes.

Conclusion

With a 125% tariff now locked in for Chinese imports and a temporary 10% window for others, Amazon sellers must adapt quickly. The shock of Trump’s tariff escalation brings unavoidable cost increases—but it also creates a rare moment of differentiation.

Sellers who focus on compliance, streamline their operations, and build review credibility will stand out.

This is not the time to panic—it’s the time to optimize.

Those who take action today—shifting suppliers, refining SKUs, and using Amazon-approved tools to build trust—can remain competitive in a reshaped global market.

The clock is ticking. Use this 90-day window wisely.

But remember this can all change if a deal is struck!